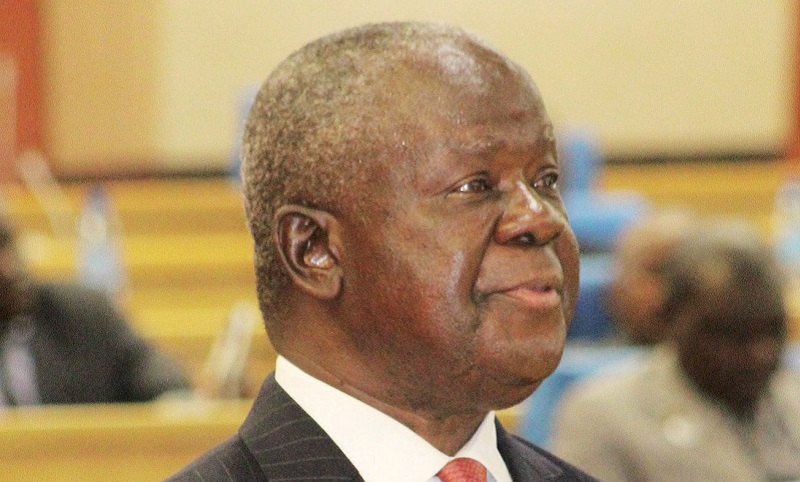

Minister of Finance Felix Mlusu says Treasury will review taxes amid growing concerns by people in the country over punitive levies.

Mlusu has made the pronouncement in Lilongwe upon a completion of a 3-day prebudget consultations that the Ministry of Finance conducted with various stakeholders.

According to Mlusu, government is aware that most Malawians are being affected by exorbitant taxes on various products and services and that Treasury will consider reviewing the levies.

“We are talking of issues of taxation where they want to see that taxes are applied in those areas that probably are not seen to be punishing or punitive to the population.

“They have also come with ideas on how we can apply these taxes efficiently in our budget framework, we have listened to those views, and we will definitely look at them and see how we are going to address them,” said the finance minister.

He however stressed that government will tread cautiously to ensure that scraping off such taxes does not negatively impact the country`s economy.

“We want to see other initiatives to encourage and motivate businesses, so that businesses can recover from the Covid-19 pandemic and grow from their.

In terms of taxes, obviously we want to look at those taxes and other measures that should promote businesses,” said Mlusu.

Recently, the Centre for Democracy and Economic Development Initiatives (CDEDI) reiterated its stand against what it calls punitive tax regimes that end up punishing the vulnerable and the marginalised Malawians who are in majority in the country.

CDEDI cited increase of prices for basic goods and services like the recent introduction of 16.5% Value Added Tax (VAT) on cooking oil, a development which CDEDI says it has pushed up the cost of living and has turned most poor people into scavengers.